,

,

- First, a little more about my education…I did not formally study calculus or algorithms after high school. Regardless, I have always had a fancy for math and after personal computers were created, I was hooked. I bought the very first IBM PC and soon thereafter discovered Excel. Since then, my life has not included even one day without counting, sorting or spread-sheeting something. Luckily, I found a career that allowed me a total immersion in numbers and I present this first lesson I learned about creating wealth.

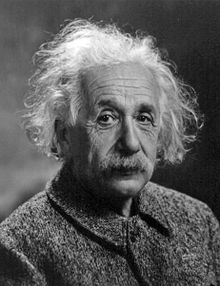

- While there is some argument about the actual truth of this story, some people say that Albert Einstein, the first person to bring science and math into pop culture, called compound interest the greatest mathematical discovery of all time. This comes from the man who solved the mystery of energy. Sometimes, it is the simplest concepts that are the most dazzling.

- This example explains his astonishment: if you invest $100,000 at 7.2% SIMPLE interest for 10 years, each year you will receive $7,200 and at the end of 10 years you will have received $72,000 total interest. Added to your original $100,000,your investment will have grown to $172,000. Instead, if your investment could receive the magic of automatic compounding, you would be able to make ” interest on your interest” each year, and at the end of the same 10 years, with the same 7.2% annual interest (COMPOUNDED each year now) your end value would be $200,423, a double of your original investment, or $28,423 MORE than the same investment with SIMPLE interest.

- A fun math fact becomes evident with this example: The Rule of 72: when the number 72 is divided by the compounded percentage growth for each period, the quotient is the approximate number of periods it will take to DOUBLE your money. Using our example: 72 divided by 7.2 equals 10 years. And we can see that our 7.2% compound interest took approximately 10 years to DOUBLE our $100,000 original investment to ~$200,000. This cannot happen without using an investment that offers compound interest, or “interest on your interest” each year. (You can amaze friends & associates by understanding and illustrating this concept at your next cocktail party.)

- A simple extension of this is the Rule of 144: when the number 144 is divided by the compounded percentage growth for each period, the answer is the approximate number of years it will take your investment to quadruple. Using the same compounded interest rate; 144 divided by 7.2 equals 20, or in 20 years, at 7.2% automatic compounded interest, your money will now quadruple; $100,000 becomes $400,000.

- Young people, make sure to take advantage of your most valuable asset, TIME! Older people don’t have as much of this priceless commodity. Today, I traveled with my father and uncle & aunt to visit a dear relative who is nearing the last days of his life. An assessment of the preciousness of time commanded space in our conversation as we drove home together.

- Comment

- Reblog

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.